| Corporate Governance Overview Statement |

|

|

|

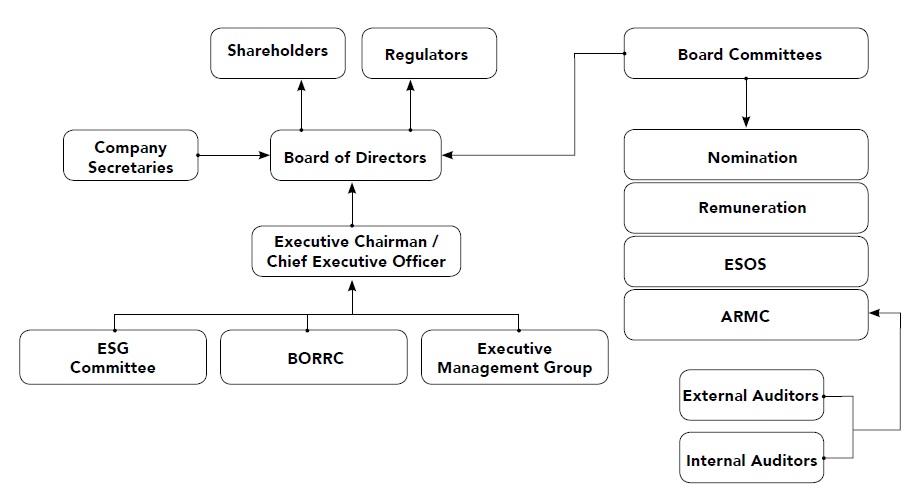

Corporate Governance Overview Statement is prepared pursuant to paragraph 15.25 of the Main Market Listing Requirements (“MMLR”) of Bursa Malaysia and Malaysian Code on Corporate Governance (“MCCG”) 2017 issued by Securities Commission Malaysia. This statement gives the shareholders an overview of the corporate governance practices of the Group during financial year 2020. This Corporate Governance Overview Statement is to be read together with the Corporate Governance (“CG”) Report which provides a detailed application for each practice as set out in MCCG 2017. This CG Report is available for reference at the Company’s website,www.globetronics.com.my,as well as on Bursa Malaysia Berhad’s website, www.bursamalaysia.com. The Board of Directors (“Board”) of Globetronics Technology Berhad (“GTB”) is committed to practice the highest standards in corporate governance throughout the Group. The Board believes that good governance supports long-term value creation. GTB has in place a set of well-defined polices to enhance corporate governance, as well as to protect the interest of the stakeholders. This statement together with CG Report demonstrates the Board’s commitment in sustaining high standards of corporate governance and outlines the extent the Group has complied with the principles set out in MCCG 2017 with regards to the recommendations stated under each principle for the year under review. PRINCIPLE A – BOARD LEADERSHIP AND EFFECTIVENESS I. BOARD RESPONSIBILITIES The Board is responsible for delivering shareholder value over the long term, in line with the Group’s culture, strategy, values and governance, while considering the interests of all our stakeholders and contributing to wider society. The Board provides entrepreneurial leadership of the Group and is collectively responsible for setting policies, which ensure that the Group’s objective and performance targets are met. There is a division of functions between the Board and the Management, whereby the former’s focus lies more on the Company’s governance; the latter on management in accordance with the direction of and delegation by the Board. Thus, the Board leads the Group and plays a strategic role in overseeing the overall activities of the Management in carrying out the delegated duties in achieving the Group’s corporate objectives and long-term strategic plans of the business. The below Group Governance Framework is established to ensure that the responsibilities and duties are discharged effectively.

The Group’s Governance Framework

The Chairman is responsible for leadership of the Board and is pivotal in creating the conditions for overall Board, Board Committee and individual director effectiveness. The Board supports the practice of separate individuals for the Chairman and CEO positions to ensure the effective functioning of the Board and appropriate balance of power and authority which is stated in the Board Charter. The Board Charter sets out the roles and responsibilities of the Board, composition and matters related to Board. it is available for reference on the Company’s website at www.globetronics.com.my. With the amendment to the MACC Act whereby corporate liability provision under Section 17A came into force on 1 June 2020, the Board has taken various initiatives to align to the procedures outlined in the “Guidelines on Adequate Procedures”, which included establishment of Anti-Corruption and Bribery Policy, enhancement of Principles of Business Conduct and Whistleblowing Policy, assessment of potential risk area and control measures as well as training and communication of the Group’s anti-corruption policy to all employees. BORRC is responsible for the implementation of the Group’s anti-corruption and bribery prevention measures. The Group emphasises its zero-tolerance position on bribery and corruption in ensuring good standards of ethical behaviour flow through all levels of the Group to prevent unethical practices and consequently, support the delivery of long-term sustainable success of the Group. During the financial year, directors and employees attended training/awareness talk on anti-corruption and bribery conducted internally and externally. The Board also provided an avenue for employees to report their genuine concerns of any unlawful or unethical situations or any suspected violation of the Principles of Business Conduct through its Whistleblowing Policy and Procedure. The Group treat all reports confidentially and genuine whistle blower will be protected from any reprisal within GTB Group as a direct consequence of the disclosure. There were no whistleblowing cases reported during FY2020. The details of Anti-Corruption and Bribery Policy, Principles of Business Conduct and Whistleblowing Policy and Procedure are available for reference on the Company’s website at www.globetronics.com.my. In order to ensure effective discharge of its duties, the Board has delegated certain functions and responsibilities to the following Board Committees: • Nominating Committee (“NC”);

• Remuneration Committee (“RC”);

• Audit and Risk Management Committee (“ARMC”); and

• Employee Share Options Scheme (“ESOS”) Committee

All Board Committees report to the Board on matters deliberated and the Board is ultimately responsible for the decision making. Each Committee operates within its respective defined Terms of Reference (“TOR”) which have been approved by the Board. The details of TOR for the respective Board Committees are available for reference on the Company’s website at www.globetronics.com.my.Reference can also be made to the CG Report for their application of the practices encapsulated in the MCCG. To assist in fulfilling their duties, procedures are in place for the board members to seek independent advice and services of the Company Secretaries who are responsible for advising the Board on governance matter. The Company Secretaries have years of working experience with sufficient skills, knowledge and resources in advising the Board on governance and regulatory matters. II. BOARD COMPOSITION The Board recognizes the importance of boardroom diversity and the practice of the MCCG pertaining to the establishment of a diversity policy in skills, experiences, knowledge, age, gender, ethnicity and educational background. The Board has in place its Diversity Policy and it is available for reference on the Company’s website at www.globetronics.com.my. The details of directors’ background, experiences and qualifications are set out on pages 6 to 11 under the Profile of Directors of the Annual Report. The overview of the Board composition, balance and diversity as of 31 December 2020 is as the below:

Note: Under the Board Experience, individual Directors may fall into one or more categories. The Board is assisted by NC in discharging its responsibilities by overseeing the selection and assessment of Directors to ensure that the Board’s composition has an appropriate mix of skills, experience, knowledge, age and gender. The Committee meets when necessary. For the financial year ended 31 December 2020, one (1) NC meeting was held. NC reviewed the size and composition of the Board, and the skills and core competencies of its members, to ensure an appropriate balance and diversity of skills and experience. There were nine (9) members on the Board of Directors for the financial year ended 31 December 2020, comprising two (2) Executive and seven (7) Non-Executive Directors, five (5) of whom are Independent. Through its review and deliberation, NC proposed that the the members of the Board be maintained at seven (7) members after the retirement of two (2) of its directors upon their completion of nine (9) years tenure. This change does not impact the effectiveness of the board as the existing members have the appropriate mix of skills, experience and knowledge to carry on the duties and responsibilities of the board. In terms of independence, the Board recognizes the MCCG’s recommendation that the service tenure of an Independent Director, does not exceed a cumulative term of nine (9) years. Upon completion of the nine (9) years, an Independent Director may continue to serve on the Board subject to the Director’s re-designation as a Non-Independent Director or the Board shall justify and seek annual shareholders’ approval in the event the director is retained as an Independent Director. If the board continues to retain the independent director after the twelfth (12) year, the board should seek annual shareholders’ approval through a two-tier voting process. NC reviewed and assessed the independence of Independent Directors and their tenure of service. Two (2) of the Independent Directors, Dato’ Iskandar Mizal Bin Mahmood and Mr. Yeow Teck Chai would be reaching their 9th year of service on 15 May 2021 and would retire accordingly. As for Dato‘ Syed Mohamad Bin Syed Murtaza who has served the Board for a cumulative term of more than nine (9) years, NC and the Board concluded that he has remained independent and pursuant to Practice 4.2 of the MCCG, the Board will seek approval from the shareholders of the Company at the forthcoming AGM to support the Board’s decision to retain him as Independent Director of the Company until the conclusion of the next AGM based on the following justifications:- (i) he fulfilled the criteria under the definition of Independent Director as stated in the MMLR of Bursa Malaysia, and being independent, he will be able to function as a check and balance, bring an element of objectivity to the Board. (ii) he remains objective and independent in expressing his views and participating in deliberations and decision-making process of the Board and Board Committees. The length of his service on the Board does not in any way interfere with his exercise of independent judgement and ability to act in the best interests of the Company. (iii) he has exercised due care during his tenure as an Independent Director of the Company as well as the Chairman of ARMC and member of NC and ESOS Committee and he has carried out his professional duties proficiently in the interests of the Company and the shareholders. Length of service of Independent Non-Executive Directors is as below:

* as at 2 April 2021 NC also recommended the re-appointment and re-election of Directors at the AGM to the Board for its approval. Directors are subject to retire by rotation at least every 3 years. Retiring Directors, being eligible, offer themselves for re-election at the forthcoming AGM. The Directors are Mr. Ng Kok Khuan, Dato’ Syed Mohamad Bin Syed Murtaza and Ms. Ong Huey Min. The Company’s Constitution also provides that any Director appointed during the year is subject to retirement and seek re-election by the shareholders at the forthcoming AGM immediately after his/her appointment. There is none for this year. NC together with the Board continues to evaluate and determine the training needs of Directors by identifying and encouraging Board members to attend various external professional training programs relevant and useful in contributing to the effective discharge of their duties. During the financial year ended 31 December 2020, the Directors had attended trainings covering a broad range of areas such as statutory regulations, corporate governance, financial reporting standards, financial planning, legal, and information technology. The details of trainings attended by each individual Director are as per disclosed in Practice 1.1 of CG Report. The Board, through NC, conducted an annual evaluation of the Board’s effectiveness and composition, including the effectiveness of the Board Committees which were undertaken internally by way of written questionnaire. The results indicated that the Board and its Committees continued to operate effectively in discharging its duties and responsibilities. Going forward, areas that the Board would like to put more focus on are related to senior management succession planning, corporate integrity, strategic opportunities and mitigation initiatives in response to the economic uncertainty in the market within the purview of the Company’s risk appetite and sustainability matters in relation to the Group’s business decision and strategies. It is the Board’s intention to continue to review annually its performance and that of its committees. III. REMUNERATION Remuneration Committee (“RC”) The RC is responsible for recommending to the Board the remuneration packages for Directors as well as senior management. The RC has in place a Remuneration Policy on Directors and senior management with the aim to provide remuneration packages needed to attract, retain and motivate Directors and senior management of the quality required to manage the business of the Group and to align the interest of the Directors and senior management with those of the shareholders. The Remuneration Policy is available for reference at the Company’s website at www.globetronics.com.my. During the year, RC has reviewed and recommended to the Board the remuneration packages for Executive Directors as well as fees for Non-Executive Directors. None of the Executive Directors participated in any way in determining their individual remuneration. Executive Directors’ remunerations are linked to their respective performance and subject to the approval of the Board. The Board as a whole determines the fees for the services of Non-Executive Directors on an annual basis and fee revision once every 2 years based on the recommendation of the RC and subject to the approval of shareholders in the AGM. The Committee meets when necessary. The remuneration for the Board and Board Committees in the form of fees for the financial year under review are as follows:

The Non-Executive Directors are paid a meeting allowance of RM500 per day for each Board meeting and/or Board Committee meeting they attend. Specific disclosure of Directors’ remuneration and senior management’s remuneration in relation to Practice 7.1 and 7.2 of the MCCG 2017 are provided in the CG report. For the financial year ended 31 December 2020, one (1) RC meeting was held. PRINCIPLE B – EFFECTIVE AUDIT AND RISK MANAGEMENT The Board is responsible for assessing the integrity of the Group’s financial information and the adequacy and effectiveness of the Group’s internal control and risk management processes. The Board delegates these specific matters to the ARMC to assist in the discharge of its responsibilities. I. AUDIT AND RISK MANAGEMENT COMMITTEE (“ARMC”) The ARMC comprises of three (3) Independent Non-Executive Directors. For the financial year ended 31 December 2020, six (6) ARMC meetings were held, and a summary of the activities of the ARMC including the internal audit function during the year under review is set out in the ARMC Report on pages 48 to 52 of this Annual Report. None of the ARMC members were former audit partners who are required to observe a cooling-off period of at least two (2) years before being appointed in accordance with the terms of reference of ARMC. Based on the External Auditors Policy, ARMC also reviewed the suitability, objectivity and independence of the external auditors. The review process covered the assessment and evaluation of their performance, quality of work, non-audit services provided and timeliness of services deliverables. The Board is satisfied that the Committee has effectively discharged its duties in accordance with its terms of reference. All members of ARMC are financially literate and are able to understand matters under the purview of the ARMC including the financial reporting process. II. RISK MANAGEMENT AND INTERNAL CONTROL FRAMEWORK The Board recognizes the importance of risk management and internal controls in the overall management process. An ongoing process has been established for identifying, evaluating and managing risks faced by the Group. During the year, the Board considered the nature and extent of the risks it was willing to take to achieve its strategic goals. The Statement on Risk Management and Internal Control which provides an overview of the Group’s risk management and internal control framework is set out on pages 60 to 63 of this Annual Report. PRINCIPLE C – INTEGRITY IN CORPORATE REPORTING AND MEANINGFUL RELATIONSHIP WITH STAKEHOLDERS I. COMMUNICATION WITH STAKEHOLDERS The Company remains committed to delivering high standards of corporate disclosure and transparency in our communications with shareholders, investors and stakeholder, except where commercial confidentiality dictates otherwise. The Company provides timely, regular, relevant and complete information regarding the Group’s businesses and corporate developments. In this respect, the Company follows the Corporate Disclosure Guide and Best Practices as proposed by Bursa Malaysia. The GTB Corporate Disclosure Policy and Procedures is available for reference at the Company’s website, www.globetronics.com.my. The Board’s primary contact with all shareholders is via the CFO and Corporate Director, who have regular dialogue and meetings with institutional investors, analysts and fund investors periodically. The Chairman and the Chief Executive Officer, as appropriate, also meet with various institutional shareholders from time to time. The outcomes of the meetings are reported to the Board to ensure that the Board keeps in touch with shareholder views. For the financial year ended 31 December 2020, there is limited physical meetings with fund managers and analysts due to Movement Control Order and border-closures arising from COVID-19 pandemic outbreak. However, both CFO and Corporate Director continue to connect with regional and Malaysian investors and analysts via conference calls and/or video conferences. They have attended more than 50 conference calls and/or video conferences. These meetings continue to keep the investment community abreast of the Group’s strategic developments and financial performance. The information published at the Company’s website, www.globetronics.com.my and announcements made to Bursa Malaysia’s website, www.bursamalaysia.com, are the key source of information for the shareholders and stakeholders. Announcements and release of financial results on a quarterly basis are posted on the Company’s website, which will provide the shareholders and stakeholders with an overview of the Group’s performance and operations. The Company’s website also serves as a forum for the shareholder and stakeholders to communicate with the Company. Requests for information or feedback on the Company can be forwarded to its dedicated Corporate Finance team through the same website. II. CONDUCT OF GENERAL MEETING Annual General Meetings (“AGM”) The AGM is the principal forum for dialogue and interaction with the shareholders of the Company. All shareholders are welcome to attend the AGM and are encouraged to take advantage of the opportunity to direct questions to members of the Board. The Company distributed the Notice of 23rd AGM at least 28 days ahead in line with the CG practice providing sufficient time for shareholders to review the Notice of AGM and appoint proxies to attend the AGM if necessary. The Notice of AGM was also advertised in The Star newspaper for the benefit of shareholders. At the 23rd AGM of the Company held on 22 July 2020, members of the Board were present and the Chairman of the Board chaired the meeting in an orderly manner and allowed the shareholders or proxies the opportunity to speak at the meeting. The Chairman presented an overview of the Company’s results and prospects at the AGM prior to the commencement of the formal business of the meeting. Members of the Board and management were present at the meeting to respond to the questions raised by the shareholders or proxies in relation to the operational and financial performance of the Group. An independent external party is appointed as scrutineer for the electronic poll voting process. In line with good CG practice, the Company had implemented electronic poll voting and would continue this practice for greater transparency and efficiency in the voting process. The Company will continue to explore the leveraging of technology, to enhance the quality of engagement with its shareholders and facilitate further participation by shareholders at AGMs of the Company. The Corporate Governance Overview Statement was approved by the Board of Directors on 2 April 2021. |